There are many reasons you might need to know how to figure your salary impose without doing a full expense form. One motivation to do a fast figuring of your assessment is to decide when you ought to do your real government form. In the event that you will get a major assessment form, you likely need to do your charges as quickly as time permits. In the event that you will owe the IRS cash, you presumably need to hold up until the latest possible time or even demand an augmentation. In the event that you are attempting to make sense of how to compute pay assess effectively read on. When you are prepared to do your duties, check the connection at the base for a duty programming audit site including locales that will do your expenses for nothing.

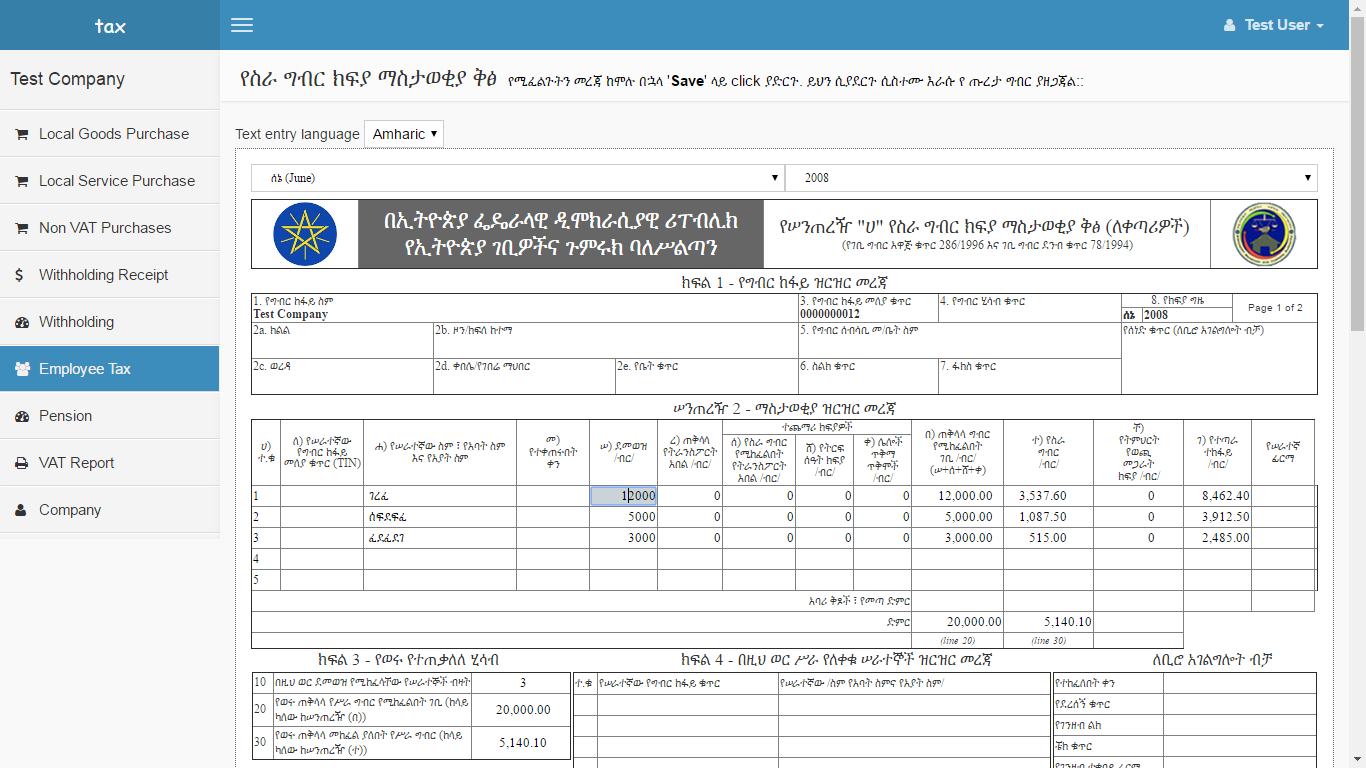

The primary thing you have to know to figure pay duty is how much cash you made and the amount you have paid in assessments. This data can be found on your compensation stub or your W2. Your compensation stub ought to demonstrate to you how much cash you have made. You have to take a gander at the “net” number since you don’t need to pay charges on specific things like 401K commitments. The other number you need is how much duty you have paid. Compose these 2 numbers down as we will require them later.

Next, you have to make sense of every one of your conclusions. This incorporates beneficent commitments, (as to your congregation), contract intrigue, and your conclusions per individual in your family, and whatever else that is assessment deductible. Simply include every one of these numbers up. Try not to stress over being precise on the grounds that you are simply getting a gauge at this moment.

Since you have your wage and derivations, I will demonstrate to you precisely generally accepted methods to compute salary assess. Whatever you do is subtract your conclusions from your salary and look into how much duty you owe for that sum. You can go to the IRS site and look into the assessment table or look at my article on duty tables (see interfaces beneath). In view of your documenting status and net wage, you will perceive the amount you owe. Contrast that with the measure of duty that was removed from your paycheck and you have your arrival sum or the amount you owe.

Each duty day, a large number of individuals face a huge number of cerebral pains over figuring something that ought to be genuinely straightforward: what amount does each of us have to pay to keep the administration running easily? Tragically, it’s a genuine agony to figure wage charge owed: you don’t simply need to know the amount you make and the amount you owe in view of that – you additionally need to do your best to exploit all the unique credits and derivations you can get for everything from having a child to purchasing a solar board.

Source: Income Tax Calculator